The Taxman Cometh – but for who? And how much?

Democrats have a tendency to solve every problem by raising taxes on the wealthy and corporations – and then wonder why they flee, cheat and create loopholes. Republicans want to clobber the lower and middle classes with taxes, and then wonder why there’s crime, drug use and a need for social programs. As with everything else, the answer lies in the middle with a compromise. Most importantly taxes need to be SIMPLE – meaning easy for people to understand and easy for people to file and pay. With proposals at the Federal, State or Local level we should know exactly WHO will pay the taxes, HOW it will affect them and how it will affect all of us.

In general, the Center Party supports a fair and common sense tax policy, including:

- Corporations must pay their share and not be able to exploit overseas loopholes

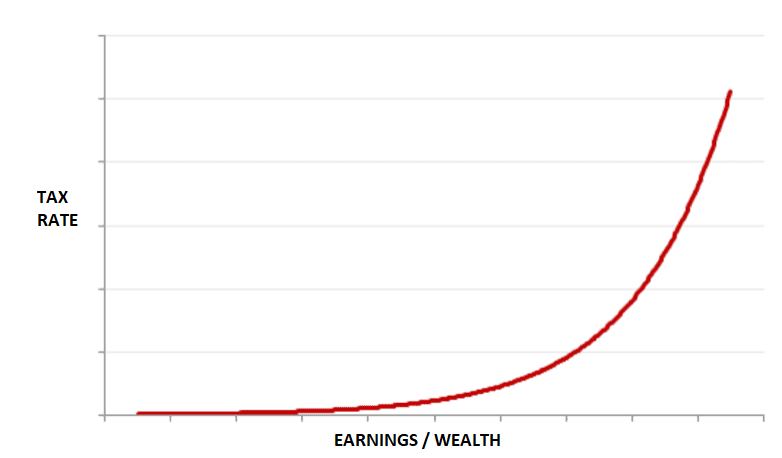

- For individuals – the more money you make, the higher the percentage of your money should be taxed – pure and simple. But wealthy people shouldn’t have loopholes either – so not only salary but also assets and profits from investing & trading, and corporate activity needs to be factored.

- Conversely the lower income brackets should pay very little – and in some cases no taxes

In other words, somebody making a million dollars a year isn’t going to be destroyed if they take home $600,000.

But somebody making $50,000 taking home $30,000 would make life extremely challenging.

Here’s the basic tax structure we support:

This will foster the rise of the lower and middle classes to be able to spend more on goods and services, invest more, save more, eliminate debt, start businesses, afford healthcare and childcare – and most importantly – reduce the need for government assistance, which will in turn, REDUCE TAXES!

Here are some other ideas:

- Federal income taxes should go to FEDERAL programs, not bailing out states

- State programs should be funded by state taxes

- Taxes should be a last resort – REVENUE, EFFICIENCY and cost reduction programs should be explored first.

- The government needs to tax LESS (right now we have income tax, sales tax, car tax, property tax, capital gains tax – EVERYTHING IS TAXED!!!) It’s ridiculous that the government taxes people to the poor house and then uses that very tax money to fund programs because people are poor.

- More programs should be funded by private donors, corporations, or individual states.

- Overall, the federal government should be leaner and more narrow in focus – focusing on funding issues that effect ALL AMERICANS (i.e. military, environment, infrastructure). More programs should be up to – and funded by – the states. The federal government should TAX less and SPEND less.

- Taxes need to be MUCH SIMPLER TO understand and pay. Right now people spend way too much time and money trying to understand the ridiculous tax codes and filing requirements. Just like with credit scores and computer security – if there’s a whole industry to help people figure it out, it’s too complicated.

More detailed policy ideas will be up to the candidates. Back to Ideas.